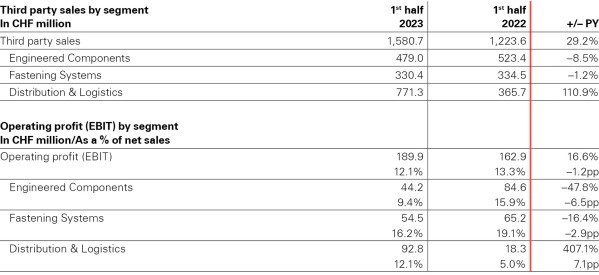

Operating free cash flow recovered and, at CHF 69.4 million, is considerably higher than in the same period of the previous year (CHF 1.8 million). Earnings per share (EPS) of CHF 3.37 (PY CHF 3.42) have been supported by the Distribution & Logistics segment. Investments in the first half of 2023 totaled CHF 81.8 million, which is equivalent to 5.2% of net sales.

On July 1, 2023, the Construction division acquired the business concerning fasteners and other products of Connective Systems & Supply, Inc. (CSS), which is located in the Denver (USA) region.

Organizational development to strengthen the customer focus

To guarantee a strong customer focus and better leverage cross-selling potentials as well as both operational and application-oriented synergies, the current Automotive and Industrial divisions are being complemented with the respective end market specific business areas of the Riveting division. This change will be implemented within the organization as of January 1, 2024. The growth and profitability targets of the EC and FS segments will remain unchanged.

In the interests of a farsighted succession planning, the Board of Directors appointed Urs Langenauer as the future head of the expanded Automotive division. He will take over from Alfred Schneider on January 1, 2024, who will continue to support SFS in selected projects until his retirement on May 31, 2024. The Board of Directors and Group Executive Board would like to take this opportunity to thank Alfred Schneider for his farsighted positioning of the Automotive division as well as for his enormous, longstanding commitment to SFS.

To make better use of the collaboration potentials in the area of technology between the Industrial and Medical divisions, the two divisions will be merged into one division called “Medical & Industrial Specials”. This change will be implemented as of January 1, 2024. Walter Kobler, who had been heading up the Industrial division as well as the Medical division, will take charge of this new division. With this step, the organizational structure of the Group will become leaner.

Sustainability-related transformation driven

SFS published its Sustainability Report 2022 in accordance with the new requirements of the Global Reporting Initiative (GRI Standards 2021) at the end of May. Not only did the SFS Group experience strong growth in 2022, but it also produced good results with respect to sustainability. An increase in the share of energy from renewable sources and a substantial reduction in direct emissions helped the Group make enormous headway on environmental issues.

Expectations for the 2023 financial year updated

The Group’s maximum customer focus and ongoing efforts to pursue forward-looking innovation and organizational projects continue to take top priority. We want to identify the chances and opportunities that go hand-in-hand with the current changes and systematically seize them.

SFS updates the outlook on the 2023 financial year and expects sales of CHF 3.1–3.3 billion, including the first-time consolidation of Hoffmann for the full year. This corresponds to an expected sales growth on a like-for-like basis along the mid-term guidance of 3–6%. For the SFS Group as a whole, an EBIT margin of around 12% is expected, at the lower end of the mid-term guidance of 12–15%.

The outlook is based on the assumption that there will be no significant deterioration in the underlying economic conditions or geopolitical, energy or pandemic-related restrictions.